In a week when international geopolitical tensions have roiled U.S. stock markets, causing a drop of more than 3% for three of the four major indices, students in one special room on the Fresno State campus have watched these economic developments closely.

Under the guidance of Dr. K.C. Chen, this class — one of two sections of FIN 129 — oversees the Student Managed Investment Funds, which allow students to gain real-world investment experience by managing a portion of California State University, Fresno’s Foundation endowment funds portfolio. The fund has grown to almost $3.8 million since the late R. Stephen Heinrichs authorized the initial $1 million in seed money in 2010 and another $1 million in 2013.

In May, a gift of $100,000 from Heinrichs, coupled with other endowment funds for a total of $570,000, established a second fund.

On Thursday, Dec. 13, the Craig School of Business and the California State University, Fresno Foundation Board of Governors will celebrate the memory of the man who made this possible, renaming the room the R. Stephen Heinrichs Trading Room. Heinrichs, who died in September 2016, was a 1968 Fresno State graduate with a bachelor’s degree in accounting and a proud member of Sigma Chi who received the Fresno State Alumni Association’s Top Dog Alumni Award for the Craig School of Business in 2008.

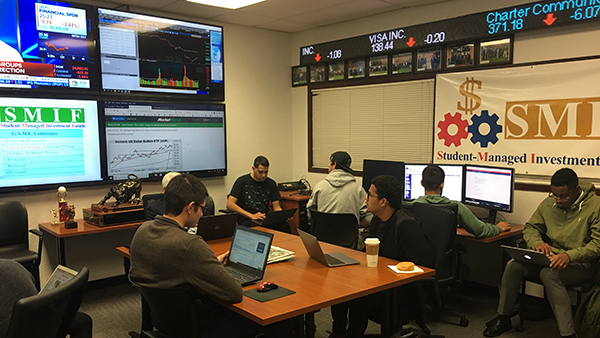

Four large screens cover one wall of the Trading Room, showing various market news and graphs. A stock ticker scrolls across the top of another wall. It’s like a stock market war room on the first floor of the Peters Business Building. But real money is at stake.

“One of the huge advantages of this class,” said Anthony Olmos, a senior finance major, “is that it’s hands-on and real world. It’s not traditional — you don’t just get standard content and a syllabus. You have to be aware basically 24 hours a day what’s going on in the markets. It’s really training us to be professionals.”

Visit Fresno State News to read more.

|